Death of the Utilization Pyramid: How AI Is Breaking the $1.5T System Integrator Model - Part I

Part I out of III: The Great Repricing

System integrators (SIs) and tech consultancies built their economics on a simple truth: sell time, stack pyramids, protect utilization. AI breaks that truth.

When configuration, integration, testing, documentation, training content, and analytics go from weeks to hours, time stops being a fair proxy for value. Pricing realigns to outcomes (revenue lift, cycle-time reduction, adoption, accuracy) and to guarantees (SLAs, SLOs), not bodies and hours.

The firms that win won't be "Accenture-but-with-Copilot." They'll be software-economics companies delivering Salesforce, SAP, and data outcomes with agentic automation, small expert pods, and productized playbooks and digital agents.

Global IT services are now the largest slice of tech spend (~$1.5T in 2024 and growing), so the repricing won't be niche - it will be systemic.

The Utilization Model's Last Stand

Traditional SI economics rest on five pillars AI undermines:

Price tied to inputs (time & materials rate cards, not results) Scale via leverage (large junior teams) Utilization as the scoreboard (75%± targets hard-wired into comp and dashboards) Change requests as margin (scope creep monetized hour by hour) Brand as risk hedge (big logos justify slower, "thorough" delivery)

Even industry benchmarks enshrine this: billable utilization in the ~70–75% range is considered "healthy," and many PSOs optimize everything around it. AI flips the sign - hours saved become penalties under T&M.

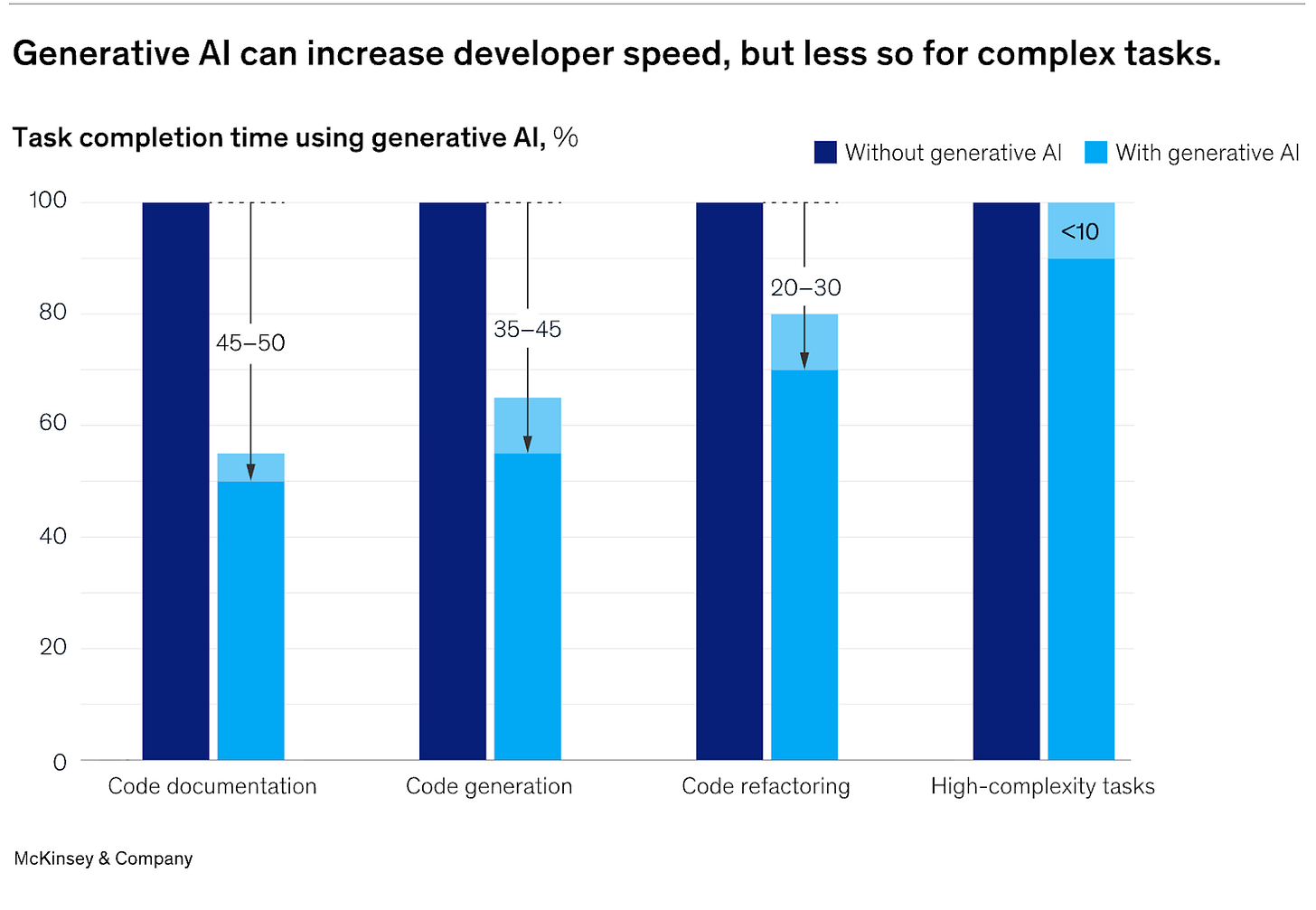

Meanwhile, gen-AI tooling already doubles speed on many developer tasks (code, docs, refactors) without hurting quality - an efficiency shock that cascades through config, test, and data work central to SI projects.

Why Incumbents Struggle to Pivot

Revenue recognition shock: Fixed/outcome pricing shifts revenue from "effort" to "effect," compressing top-line unless deal volume and cross-sell rise.

Utilization becomes noise: When agents do the grunt work, human hours become a scarce bottleneck you want to protect - not maximize.

Pyramid politics: Career paths, staffing, and partner draws were designed for leverage, not automation.

Procurement muscle memory: Buyers compare rate cards; moving them to risk-share/outcome models takes evidence and trust.

Tool parity risk: If everyone licenses the same AI tools, workflow/IP (playbooks, orchestration, proprietary data) is the only moat.

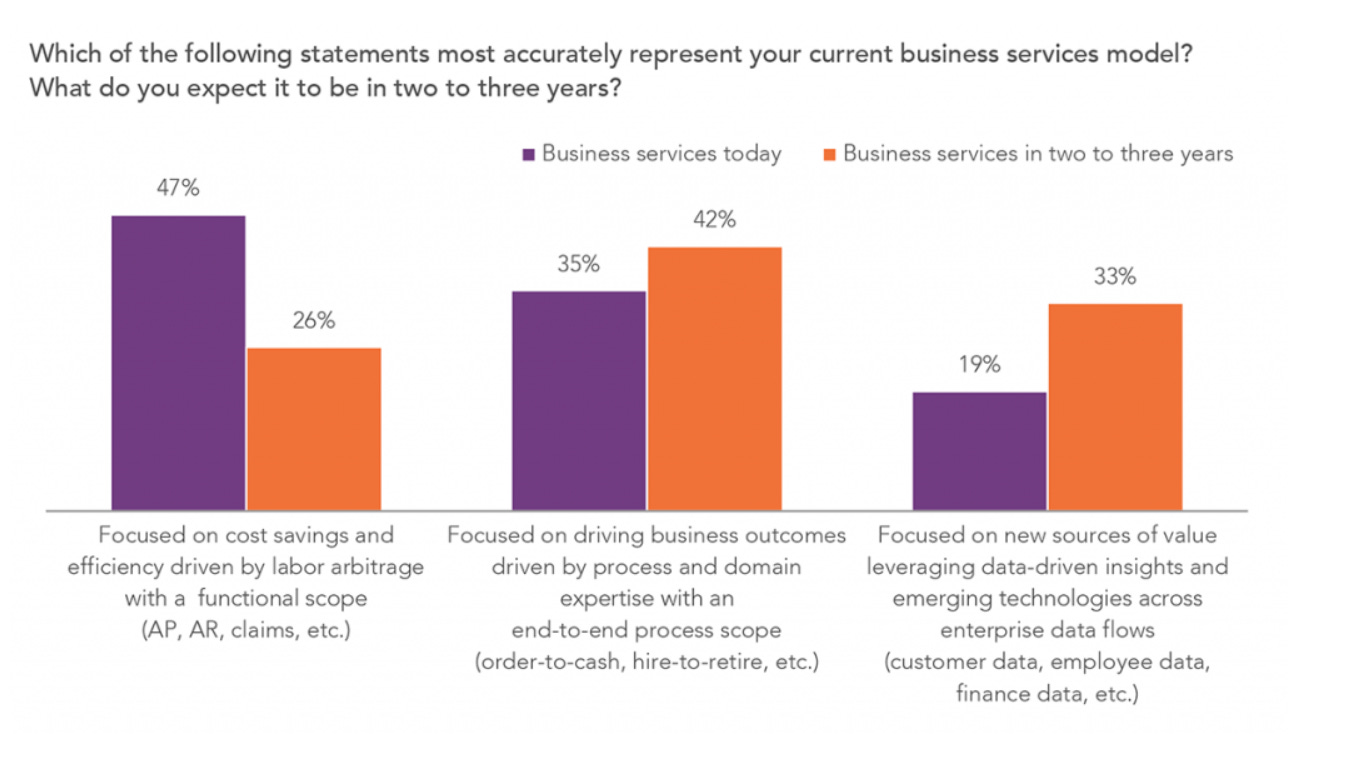

Market signals say the shift is underway: outcome-aligned managed-services models are being renegotiated at scale; research houses forecast a transition from FTE pricing to performance / outcome constructs; and "Services-as-Software" is emerging as the design pattern for next-gen delivery.

The Platform Tailwinds (Salesforce & SAP)

Salesforce: Salesforce is pushing Agentforce - consumption-priced AI agents that automate CRM actions. These aren't toys; they change the unit economics of sales/service delivery and what clients expect from partners.

SAP: S/4HANA migrations have created a multi-year wave, with large backlogs and heavy partner reliance to execute. Add SAP's NVIDIA alliance and Joule-style copilots, and you get automation embedded into core ERP processes - fertile ground for outcome pricing. (Data points: +28% YoY S/4HANA backlog in Q1'24; 77% of customers rely on partners for S/4 moves; ~85/100 largest companies on S/4.)

Translation: The platforms themselves are shipping agents and copilots. If you bill by the hour in a world where the platform completes the work, you lose pricing power.

The AI Pricing Inversion: From Hours to Guarantees

Old world: "$X/hour for certified admins, developers, and architects." New world: "$Y for a guaranteed outcome, delivered in Z weeks, with SLAs."

Outcome menus (illustrative):

Salesforce: +10–20% pipeline hygiene within 60 days; forecast accuracy ±3%; CSAT +8 pts; AHT −20%; AI-assisted case deflection +15%.

SAP: Order-to-cash cycle - 30%; DSO - 10 days; on-time delivery +8 pts; close-to-report - 40%; automated regression tests covering 80% of critical Fiori flows.

How you charge: Flat fees with gain-share if outcomes exceed targets; "pay-per-event" (e.g., per correctly executed agent task); or managed subscriptions tied to SLAs. This aligns with the broader market's move toward outcome-based constructs.

Where the Pyramid Collapses First (High-Automation Lanes)

Build/config: Metadata configs, object/field setup, flows, validations, Fiori app scaffolding → agentic + template kits.

Integrations & data: Mapping, ETL/ELT, test data synthesis, data contracts → LLM-assisted generation + policy checks.

Testing: Unit/UI/API regression, performance baselines, SAP TBOM impact analysis → autonomous test bots.

Change management & training: Auto-generated guides, in-app walkthroughs, personalized curricula → content agents.

Analytics: KPI wiring, semantic models, dashboard scaffolds, guardrails → pattern libraries + "explain my metric" agents.

McKinsey's measured 2× speed gains in software tasks foretell similar compression across these lanes as they're codified into workflows.

The Hidden 10× Market Expansion

Lower cost-to-serve means mid-market firms can finally afford "big-company outcomes." Salesforce's ecosystem alone is forecast as a massive job & GDP engine; SAP's long migration tail guarantees demand for years.

The wedge isn't replacing incumbents at the top - it's unlocking the underserved middle with fixed, verified outcomes.

Coming in Part II, III: The three paths forward (only one is venture-scale), the AI-native SI playbook, and why the hour won't die - it will just shrink 3-10×. We'll dive deep into the practical implementation strategies and what this means for leaders in the next 12 months.

Part II

Part III

Really enjoyed this series. It’s very interesting to reflect on how the price of goods and services materializes. I’m not an economist, but I recall the basic principle of supply and demand: if work takes fewer hours, the product should become cheaper in a competitive market. In reality, though, some businesses benefit from inefficiency and are reluctant to change at an industry level. IT companies may even implement new technologies in ways that maintain duplicative processes, or generate extra work if the software itself is inefficient. Still, the direction is clear, even if progress can feel slower than it should. Thanks for the insightful read. (P.S. there is the same link for part II and III , in case you update link for part 2 - will be great)