Death of the Utilization Pyramid: How AI Is Breaking the $1.5T System Integrator Model - Part III

Part III: The Transition Strategy and New Operating Model

In our final installment, we examine the practical realities of transitioning to AI-native delivery and what leaders must do in the next 12 months.

The Hour Won't Die - It Will Shrink (3-10×)

Reality check: many enterprise buyers will still prefer hourly billing because it's familiar, auditable, and avoids profit-sharing with vendors. But that alone reprices the entire market.

Why Buyers Stick with T&M (For Now)

Procurement Muscle Memory: Hourly line items map cleanly to budget controls and audit requirements that finance teams understand.

No Profit-Share Optics: CFOs don't want to "tip" vendors on cost savings they believe should naturally accrue to the business.

Risk Simplicity: While legal, security, and data policies evolve around AI agents, T&M feels like the lowest-friction contract structure.

The Implication: Even if pricing structure stays hourly, total spend collapses because hours collapse. The utilization pyramid crumbles from the bottom up.

Margin Migration: AI Vendors Will Tax the Stack

Expect LLM and platform agent licenses (plus vector databases, evaluation services, guardrails) to skim margin from traditional SIs:

Client OpEx Shift: ↓ services hours, ↑ AI/software subscriptions

SI Margin Pressure: Squeezed unless you monetize orchestration IP, proprietary data, and outcome guarantees

Historical Precedent: Low-code/no-code compressed build hours, but savings mostly flowed to platforms while SIs pivoted to advisory work. This wave follows the same pattern - just bigger and faster.

Who Gets Hurt, Who Survives

Body-Shop Outsourcers (heavy junior leverage) face the biggest squeeze. Engagements needing 100 people now need ~30. Many large vendors will abandon "shrunk" scopes (falling from $5M to ~$1M) because overhead and politics aren't worth it.

Managed Service Providers likely survive better - their pricing is already thin and consumption-based, with less fat to squeeze and more behind-the-scenes automation opportunity.

Mid-Market Specialists inherit the orphaned work: right-sized pods that can profit on $500K–$1.5M scopes the giants no longer want.

Strategic Response: Build the AI Factory

The winning move is systematically deflating hours through an "AI Factory" approach:

Core Components

Process Blueprints: Standardized workflows for common Salesforce/SAP value streams (O2C, forecast accuracy, case deflection, ATP, R2R)

Agent Orchestration: Auto-generation of configs, tests, data mappings, and change artifacts

Evidence Systems: Comprehensive tracking of diffs, test runs, and before/after KPIs to neutralize procurement pushback

Flexible Commercials: Maintain T&M options (delivering in 1/3 to 1/5 the traditional hours) plus fixed-fee and SLA bundles for ready buyers

Pricing Patterns You Can Implement Tomorrow

Hour-Lite T&M: Publish compressed hour plans (65% fewer hours vs. baseline) with transparent AI-ops costs so finance teams see the trade-off clearly.

Fixed-Fee Commissioning: Flat price for agent setup and playbook implementation, with separate change budgets for edge cases.

SLA Bundles: Monthly fees for uptime, accuracy, and cycle-time guarantees, with credits for missed targets.

Gain-Share (When Asked): Only implement when CFOs specifically request it - don't push this model uphill.

Operating Model Changes (Making the Math Work)

New KPIs

Retire human utilization as the North Star. Track instead:

Percentage of work automated

Mean Time To Outcome (MTTO)

Verified KPI improvements delivered

Staffing Evolution

Fewer juniors: Reduced need for large teams of junior consultants

More specialists: Solution principals, model/agent owners, risk stewards

New roles: AI orchestration experts, outcome verification analysts

IP as Product

Treat blueprints, test suites, prompts, and data schemas as licensable products, not just internal assets. Create renewal models around your intellectual property.

Supplier Strategy

Negotiate platform-wide AI licensing early. Bundle tokens and credits into client offers to prevent bill shock and maintain pricing predictability.

What Leaders Must Do (Next 12 Months)

For Platform Vendors (Salesforce/SAP): Lean into agent marketplaces and certification programs tied to outcome SLAs. Create partnership tiers based on verified delivery capabilities.

For Enterprise Buyers (CIOs/CFOs): Pilot outcome-priced pods on one specific value stream (e.g., forecast accuracy improvement). Lock in learning, then scale successful models across other processes.

For Incumbent SIs: Spin up an AI-native line of business with separate P&L, compensation structures, KPIs, and contracting approaches. Don't try to graft new models onto existing pyramid structures.

For Founders/New Entrants: Build focused wedges where you can prove ROI in 60-90 days using platform agents plus your own orchestration IP. Start narrow, then expand horizontally.

The 2030 Endgame

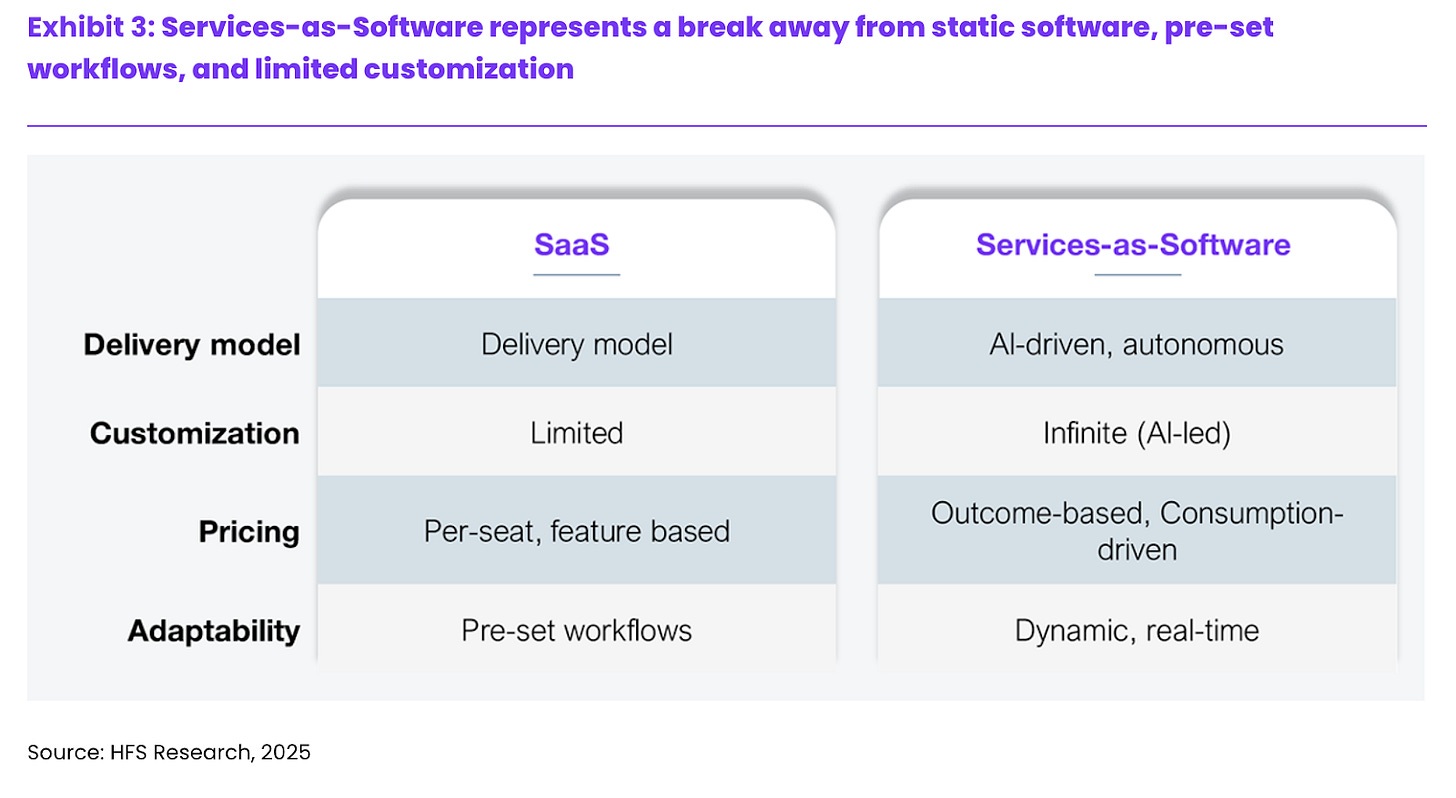

By decade's end, most Salesforce/SAP "work" becomes Services-as-Software: autonomous agents executing repeatable workflows, human-verified, sold with guarantees.

Hours won't disappear entirely - they'll concentrate on strategy, change leadership, and complex edge cases. But most delivery revenue migrates to fixed, consumption, or outcome-based pricing.

The brands that matter will own three things: outcomes, workflows, and data. Everyone else will rent tools and watch margins compress.

Bottom Line: Own the Shrunken Middle

Most clients will keep buying hours initially - they'll just buy far fewer. This alone detonates traditional utilization economics. Combined with AI vendors claiming their share, the market restructures around lean, AI-native SIs winning work that giants abandon.

Build your AI Factory now. Collapse the hour padding systematically. Own the profitable middle market before everyone realizes it's the best ground left.

The utilization pyramid is dead. Long live the outcome economy.

Sources & notes

IT services segment scale and growth: Gartner forecast coverage indicating ~$1.5T IT services in 2024 and the largest segment of IT spend.

Utilization benchmarks as a core PS KPI: SPI Research benchmark summaries and commentary on ~70–75% norms.

Gen-AI productivity evidence (2× speed on many developer tasks): McKinsey research.

Salesforce AI platform signals (Copilot GA; Agentforce/consumption interactions): public coverage and Dreamforce previews.

SAP migration/partner reliance/backlog and AI tie-ups: SAP ecosystem brief and SAP-NVIDIA announcement.

Outcome-based pricing & Services-as-Software: HFS/KPMG managed-services outlook and HFS Services-as-Software thesis.

Market structure shift with boutique AI consultancies: reporting on new AI-led challengers.